Just like the crypto lending systems still expand, the main topic of interest rates for cryptocurrencies have a tendency to gain benefits. Now’s a great time to review the basic principles.

How can Interest rates Functions?

Lenders costs desire into loans for individuals and businesses. People borrow cash to shop for larger-solution items like a home, auto, otherwise educational costs. Simultaneously, enterprises have fun with borrowed loans, otherwise commercial obligations, to pay for the much time-title programs and you will opportunities. Banking companies plus borrow cash, often away from some one. When you put money at a bank youre effortlessly credit they on financial in return for the bank purchasing your the brand new going interest rate . Hence, in the event the rates is actually highest and you are a borrower, in that case your financing could be costly; however, if you happen to be a lender, or saver, up coming you’ll obtain a whole lot more profit from the greater prices.

Just what Identifies Rates of interest?

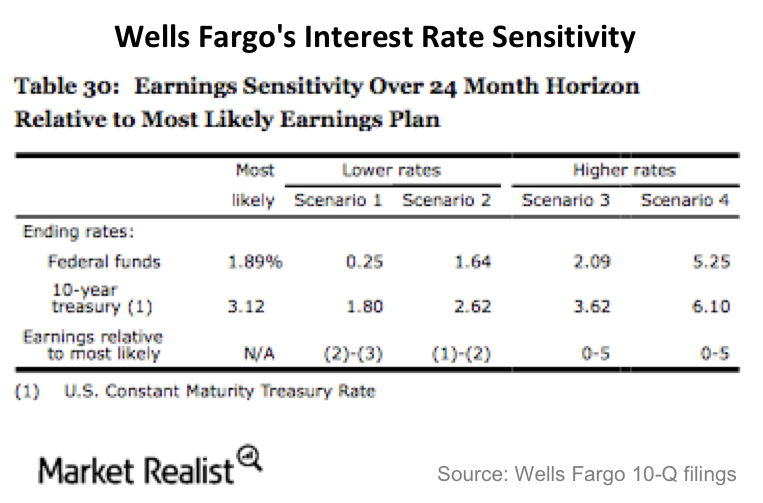

In the us, the newest Government Put aside (the latest Given) establishes rates of interest according to the federal loans rate or overnight rates, which is the price one commercial banks charge one another in order to give or borrow funds on straight away markets. Finance companies utilize the newest interest to determine what annual commission cost (APR) to offer. An annual percentage rate is almost usually more than an interest rate as the it means the fresh buildup away from a whole year of great interest cost and also other can cost you particularly broker costs or closing costs. And if you’re contrasting mortgages, the newest Annual percentage rate ‘s the far more accurate price to consider.

New federal financing rate including variations the basis with the prime speed , hence banking companies use having small-label products like variable-rates mortgages, auto loans, playing cards, and you will domestic security financing. The prime rate was expressed because Prime + a portion, that is fundamentally throughout the step 3% more than the new federal money rate.

A bank will always offer anyone finance with assorted rates of interest dependent on a keen applicant’s private quantity of risk. In the event that a lender believes discover a spin you to definitely a customer might maybe not pay off their loans, this may be will most likely not offer them a loan whatsoever, or offer all of them a top interest. If the a customer has actually the lowest credit rating, then bank will in all probability offer that person a higher rate of interest than it can for an individual having an average borrowing from the bank rating. A lender tend to generally speaking provide their popular users, individuals with pristine borrowing from the bank suggestions plus the higher fico scores, the top speed.

Repaired Versus Adjustable Rates

Banks charges possibly repaired or varying interest levels. Fixed-pricing stand a comparable into life of that loan; and you can initially, your repayments often sits mostly away from paying down the eye. But over time and you also lower your debt, you’ll be able to are obligated to pay all the more large servings of your prominent amount borrowed . Variable-rates changes on prime speed and could affect one particular debt software without a predetermined-interest.

Home financing may come in the way of a predetermined- or varying-price financing. Within the the lowest-interest-rates sector, a changeable-speed financing you’ll work with the brand new debtor as its payments you are going to disappear given that pricing drop-off, in a top-interest-rate environment, an excellent borrower’s repayments are susceptible to boost and value them significantly more over time. Each type out of speed includes positives and negatives. Ahead of borrowing or financing funding of any type, it is essential to check out the kinds of financing readily available and additionally their interest cost.

Large In place of Low interest

Highest rates create money more expensive. When rates was high, individuals and you may organizations may struggle to borrow. This leads to shorter available borrowing from the bank to fund purchases, which can result in consumer demand in order to stagnate. Low interest rates, on the other hand, do interest in larger purchases such as a home, which usually need money. Low interest together with create business loans more affordable, hence encourages the people in order to launch and you may brings in it the fresh new possibility of this new perform. In the event the low interest rates provide these positives, upcoming why would not rates getting leftover lowest from day to night? Even in the event governments carry out try to keep interest levels reduced, they should be mindful as an enthusiastic insidious side effects away from low interest try rising cost of living. With rising prices, the expense of products and you will qualities increase additionally the dollars features less to shop for stamina, which could make something harder in the event you currently strive to shop for basics.

Getting Appeal on Crypto Lending Networks

Versus borrowing from the bank and credit contained in this traditional locations like a property, borrowing and you can credit in the cryptocurrency market is nevertheless within the start. But not, the growth away from crypto lending networks and heightened requirement installment loans for bad credit in Memphis for rates to have crypto you may deeply replace the place. Credit and you will financing currency could potentially build markets activity to possess cryptocurrencies in the two ways. First, the thought of interest levels try common to help you people when you look at the traditional financial markets. Thus some investors – whom perhaps was not familiar with crypto in earlier times – you will end up being attracted to cryptocurrencies more it follow rates. Next, of these dealers which already keep cryptocurrencies, the outlook out-of collecting appeal can offer them a reward so you’re able to provide they, also – therefore causing the latest circulate regarding property for the crypto locations.

Cryptopedia cannot ensure the accuracy of the Site content and you can shall not be held responsible for one errors, omissions, otherwise inaccuracies. The fresh opinions and you can feedback shown in any Cryptopedia blog post is actually solely the ones from the writer(s) plus don’t reflect this new feedback regarding Gemini otherwise the government. Every piece of information provided on the website is actually for informational objectives merely, also it does not create an approval of every of your own products and services chatted about or investment, financial, or trade advice. A qualified elite group should be consulted before you make financial behavior. Please go to the Cryptopedia Site Policy to learn more.

Recent Comments