To have veterans examining channels to create wealth using home, the chance of Va finance runs past conventional household instructions personal loans in Iowa. Virtual assistant funds, designed to encourage experts to their homeownership travel, supply a proper path to have veteran investors eyeing financing functions.

Within this weblog, we are going to navigate the newest the inner workings of utilizing Va fund inside the Tx getting financial support properties and you will expose new proper positives they give veteran traders.

A guide to Virtual assistant Funds

During the its key, Virtual assistant financing try an effective financial unit to have veterans, offering aggressive rates of interest and you may getting rid of the need for a lower commission. If you’re primarily of the to shop for number one houses, Va money hold unexploited potential for veteran investors trying strategy to the a house expenditures.

Eligibility Conditions for using Virtual assistant Money to have Opportunities

To help you power Va fund to have capital functions, pros need to understand specific qualification conditions. Fulfilling Va financing conditions when you look at the Colorado to own low-priiliarize themselves towards the assistance ruling it strategic monetary strategy.

Benefits associated with Having fun with Va Loans to have Capital Services

Brand new financial great things about Va loans stretch effortlessly to help you financing attributes. With aggressive rates of interest and also the removal of a deposit requirement, seasoned traders is exploit such advantageous assets to boost their real property financing portfolios.

Navigating new Approval Techniques getting Funding Characteristics

Obtaining good Va financing targeted at money functions involves a great unique recognition techniques. Experts must go after a step-by-action publication, making sure records and you will recommendations align with the conditions to own non-primary household deals.

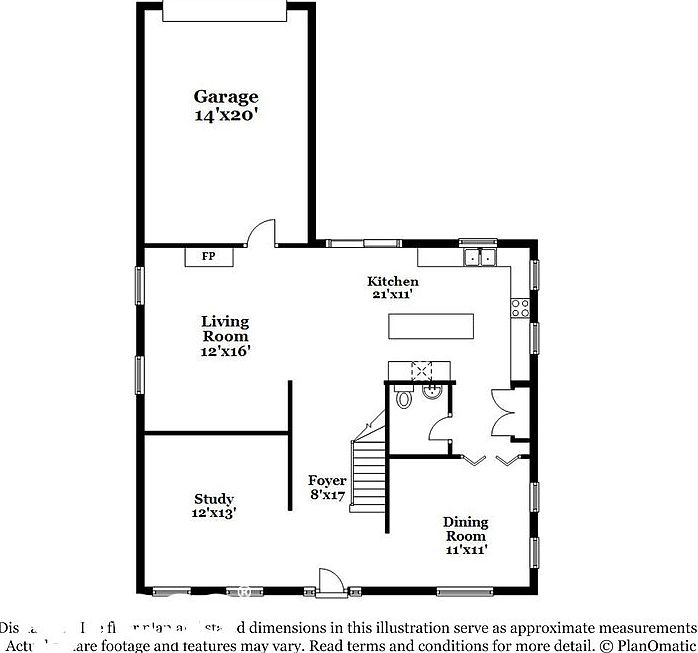

Choosing the right Capital Qualities

Proper ount when choosing capital qualities. Veteran dealers must look into issues instance location, assets type of and you may prospective return on the investment to help you line-up their options using their monetary needs and maximize the great benefits of Va finance.

Strategies for a successful Capital Profile with Virtual assistant Funds

Strengthening and you can managing a profitable investment property profile need strategic think. Experienced investors will benefit from important tips, as well as information on the possessions management, market research and enough time-term planning optimize the money strategy.

So you can Summary:

Seasoned investors has actually a strategic unit during the Virtual assistant money whenever navigating the world of investment services. Because of the knowing the advantages, appointment qualification conditions and you may using strategic choice-while making, experts can open the full possible regarding Va financing to create money as a result of home.

As you continue your investment travels, look at the unique advantages of Virtual assistant financing and speak about the possibilities they offer during the increasing and you will enhancing forget the property portfolio. Get in touch with The latest Texas Home loan Pros right now to learn their Va qualifications.

Part Manager at the Tx Financial Professionals NMLS# 268552 NMLS ID 286357 Part NMLS #: 268552 118 Antique Playground Blvd W443, Houston, Tx 77070, All of us

Trying to get USDA Mortgage brokers Colorado: Useful Choice for People in the Texas

Try to order a property in the Colorado things in your concerns over the years? But missing out on funding choice one complete your loans criteria with the absolute minimum down payment? USDA mortgage Colorado ‘s the way to go enabling lowest earnings people away from outlying portion who will be losing short of bringing old-fashioned mortgage loans to buy a property. Having USDA family

USDA Financing Certification: Greatest Help guide to Top quality to own Mortgage into the Texas

To buy property for the Texas has always been the difficulty to own some body within the rural components with lower income and the extended certification process of capital solutions. Well, the united states authorities generated one thing convenient with USDA Home loans having effortless financing qualifications conditions. USDA financial or USDA Outlying Invention Secured Property Loan System function offering mortgages to home owners into the

- Learn more about Us

- Mortgage Software

- Website Chart

Scoop Investment LLC (DBA Heart City Credit) NMLS# 1744962 Is A residential Real estate loan Business, 9002 FM 1585 #Grams, WOLFFORTH, Texas 79382. The rate, Apr, Mortgage Charges Is founded on Credit rating, Loan To Worthy of, Amount borrowed, Mortgage Sorts of And other Things. Not all the Users Tend to Meet the requirements. There is absolutely no costs add financing consult, score matched which have loan providers and you may found conditional financing even offers otherwise rates. You may review new conditional financing also offers otherwise rates and you will talk into lenders free of charge. Without a doubt, the lender you decide on may need a fee to processes the formal loan application, assessment, and/otherwise credit history, but if you do not commit to pay the bank people payment(s), you may store that have Center Urban area Lending. free-of-charge.

Recent Comments