Extent your be eligible for which have a credit rating of 550 relies upon the lender. Avant considers borrowers which have a credit rating away from 550 to own funds to $thirty five,000. OneMain has no the very least credit score and can provide right up in order to $20,000. The latest cost for these fund is really as large as the %, which will make their desire will set you back most high priced.

If you’re a high-money low credit score borrower, you can get a living established loan. But, basic, you really need to observe much you might use based on your revenue to choose perhaps the loan amount meets your needs.

How can money-founded finance work?

Income-established loans are generally only personal loans with different conditions in order to meet the requirements. In place of setting the essential weight towards the credit history, they focus on money. As for how they works identical to a frequent personal loan. Oftentimes, you’ll need to begin by delivering prequalified. Once prequalified, you may have to fill out extra papers and take a lot more tips locate pre-accepted. Shortly after acknowledged and you may financed, funds shall be acquired since the a lump sum of cash that have a fixed cost agenda. Generally speaking, costs is actually owed once a month consequently they are fixed that have attract incorporated. Very personal loans don’t possess using limits, but this is simply not an invite to blow them carelessly. Unsecured loans are purposed in many ways that can work with your own lifestyle and monetary situationmonly, personal loans can be used for debt consolidating, renovations, wedding receptions, issues, and much more.

Taking right out a consumer loan will be a great way to combine debt, security unexpected expenses, otherwise finance a primary get.

Assuming you may have a steady income, you are in a position to qualify for a full time income-mainly based personal bank loan, or fund based on money, not borrowing.

These money are generally more straightforward to qualify for than just old-fashioned funds, and they usually include lower interest levels. Due to the fact label indicates, income-established personal loans are based on your capability to settle brand new financing, instead of your credit rating. This means that even though you possess less than perfect credit, you may still have the ability to qualify for such financing.

- Get approved for a loan instead spending date reconstructing or building your credit rating

- Zero spending constraints (oftentimes)

- Reasonable monthly obligations

Exactly what are the drawbacks out-of money considering earnings?

There are many prospective downsides of funds considering easy loans to get in Allenspark earnings, and there is with a lot of loans. Before taking out that loan you need to know advantages and disadvantages certain on the condition. Listed below are some general downsides cash-created fund:

- Need sufficient income to help you be considered

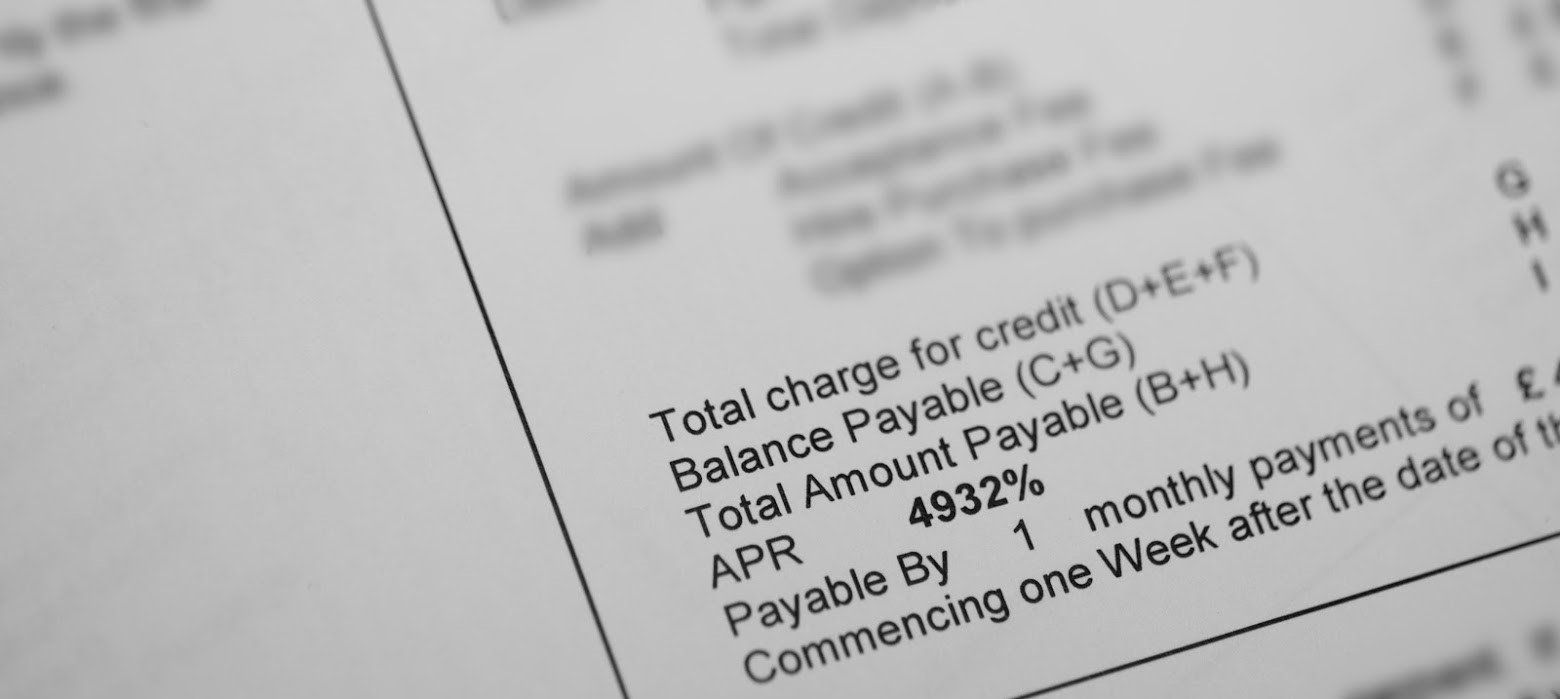

- Rates of interest is large

- Earnings can change, ergo leaving you having a fees youre unable to manage

Were there origination fees on finance according to income?

There are various type of finance offered, for every single along with its very own group of small print. Certain fund have origination fees, while others do not. Origination costs are generally a percentage of one’s complete amount borrowed, and they are paid down of the debtor in the course of financing inception. Income-centered loans may or may not has origination charge, with regards to the bank.

Of several unsecured loans centered on money, maybe not credit rating, that are available from the authorities providers don’t have origination fees, if you find yourself private loan providers can charge an enthusiastic origination payment as high as 3% of the amount borrowed. Borrowers is to ask about origination charge before taking aside an income-built financing.

Is also money-depending loans create your credit score?

It’s a familiar misconception one to earnings-mainly based funds may help improve your credit score. While it’s true that and work out fast repayments to your any financing can also be help to improve your credit rating, income-built finance could possibly get performs differently.

Recent Comments