Ought i get a home loan having late money demonstrating back at my credit report?

This is probably the most well-known matter and you will issue we come across the, given that literally we have all overlooked the fresh new unusual fee no less than shortly after in their existence.

Unfortuitously, of many lenders aren’t necessarily really sympathetic about any of it and certainly will refuse without a doubt otherwise creditworthy people on account of a record of has just skipped repayments to their credit data files or by the low credit rating one results. Appealing these types of refusals are a mind-numbing and you will stressful procedure thus its generally better to just move forward and acquire an enthusiastic option lender who’s in fact attending look at the application from the fresh start.

Luckily for us, getting a home loan which have an overlooked payment is achievable so there try lenders ready to think such as for example candidates, also borrowers which have multiple late money, which have a reduced deposit and at competitive rates.

- One or two late money

- Multiple later money

- Unsecured late costs

- Financial late costs / Home loan Arrears

- Safeguarded financing late repayments

What is the difference between late payments and you may arrears?

Later payments was isolated payments missed on any type of account you to stays because the status you to definitely in your credit reports but is today state of the art. Most creditors enables consumers before prevent of schedule few days in advance of they check in that it as the a formal overlooked commission towards its credit history. Therefore, when your percentage date ‘s the initial of the few days and you may make payment on the newest 21st, many loan providers often look at this repaid into time’ and never statement the new event in order to credit resource organizations.

Arrears is missed costs you to definitely slip after that behind, going unpaid-for more than thirty days. A person is classed just like the inside the arrears’ once they currently are obligated to pay more than their newest month’s payment.

The sort of account you may have skipped a charge for renders even the greatest improvement as to if or not you may be recognized to possess a home loan or not.

Two skipped costs taking place a few years ago on some thing unsecured is not likely to stop you from being Georgia installment loan direct lender approved from the about several loan providers but, when you yourself have a mortgage that have late costs on your borrowing from the bank declaration (including missed repayments for the secured finance), chances are you’ll see things more challenging and you will dependent, about how of several and how latest they certainly were, you’ll need more substantial put and discover an effective bank.

Number of overlooked payments

Having you to missed commission on the credit history in the last six decades is not going to cause excessive damage, though it can get lower your score should this be new and can even suggest a number of the finest lenders tend to nevertheless refuse your own home loan software or perhaps present a higher level. Having multiple missed repayments might have a much big effect on cutting your credit history and you may find the majority from standard lenders have a tendency to decline the job otherwise offer conditions reliant your having more substantial put available.

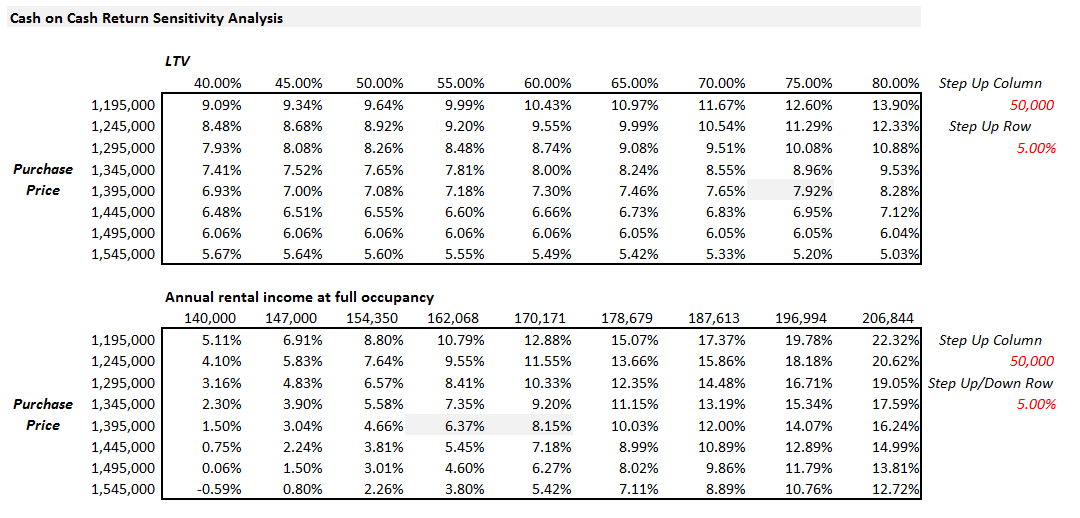

That is an essential point to think of for individuals who apply to their financial getting state 85% LTV, as well as offer a binding agreement however, at 70% LTV, it appears that credit rating together with them is not good enough to qualify for the higher LTV. It will not indicate that you simply will not be able to find a different lender that will imagine a keen 85% LTV even with what the first bank you will say so you’re able to persuade that make use of them. Often times it may well function as the case your limit people financial usually think is 85% LTV, but far better fatigue the avenues with the home loan you desire ahead of needing to sacrifice.

If you wish to acquire a great 95% mortgage which have skipped repayments then it’s certainly you are able to, if you commonly over 3 months trailing on anyone membership.

Recent Comments