Brand new life of a home loan in The newest Zealand is sometimes between twenty five to three decades. As financial continues a long time, even if interest rates was seemingly low, you wind up investing comparable number back into notice as you have lent into the dominating. For those who glance at the infographic within the next area, so as to once you obtain $3 hundred,000 over 30 years from the 5.45%, you wind up paying back $609,533 overall.

Inspire, $309,533 only during the appeal costs, that’s more that which was lent in the beginning! This is the real cost of home financing; it persists so long, you find yourself make payment on financial away from twice – immediately after into the principal and once on the desire.

Just what impression do and make more repayments have?

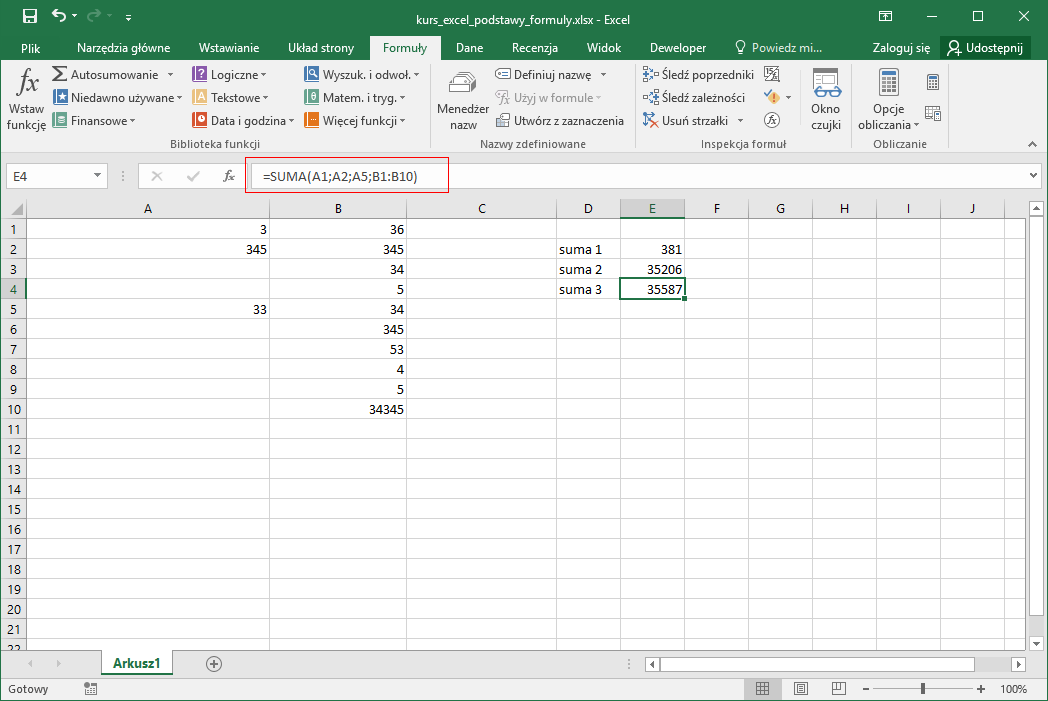

I’d an improve and possess $50 dollars remaining weekly, therefore which is $100 for each and every week or two a lot more I am able to wear my fortnightly repaymentsparing the 2 conditions below suggests how to extremely gain worthy of regarding leading more funds into the home loan. Reducing a massive 5 years and 10 months off the mortgage lives and you can a preserving from $65,365 into the notice. The primary is that you spend appeal for a smaller several months of your time which translates into a dramatically reduced loans.

Just what more do i need to envision?

There is absolutely no concern that the figures significantly more than inform you the benefit of putting additional finance into your home loan however, that doesn’t fundamentally suggest if you’re within this position you need to do it, there are other points to consider.

The excess funds can get serve you best if you place all of them on the building good varied capital collection, this will shield you from industry certain unexpected situations. Resource options such Kiwisaver will likely be a sensible entry to money significantly more than your own financial and you will livings can cost you.

There are a lot of you should make sure as well as the choice will depend your life style and you may wants on small in order to a lot of time identity coming. When you’re in this standing and you are clearly not knowing just what finest highway is you will be talk to a professional monetary adviser.

Extra Home loan repayments Summation

- http://cashadvancecompass.com/installment-loans-sd/hudson

- Most financial costs = less overall loans, smaller benefits, less for you personally to being home loan free which is great.

- You can even lose out on most other investment ventures for those who focus entirely on your own mortgage.

- Additional money paid toward a mortgage most frequently cannot be withdrawn if you prefer they once more versus home financing reconstitute.

And make extra repayments towards the top of your monthly repayments makes it possible to pay back the financial shorter when you are expenses shorter notice. Very one thing extra you put in at that moment will certainly reduce the primary matter, you would-be repaying interest on your financing for a shorter amount of time – this means your shorten living of financing and relieve your interest will cost you.

Charge such as for example; Application/Facilities, Annual plan, Monthly, Launch, Valuation, Judge and you can Settlement to expect whenever checking out the techniques and having a loan.

It depends for the personal, and you will whatever they is manage within their budget. Yet not, it must be detailed you to notice to the mortgages has a tendency to accrue day-after-day, very preferably, settling a week can save you much more interest than just paying off fortnightly. Weekly and fortnightly repayments have a tendency getting much better than expenses month-to-month finally.

That loan Arrangement is an extremely in depth listing of financing involving the debtor and you may lender that usually includes information regarding how the loan would be paid and if. A loan Agreement in addition to directories the brand new duties each party has with reference to the loan, like the loan costs schedule.

A fixed interest is one that’s repaired, otherwise secured for the, at this number and does not alter to have a flat several months – instead of a floating or varying rate of interest. Having repaired rate lenders, the newest fixed several months is typically in one to help you five years. It means the normal home loan repayments remain a similar with this months.

Recent Comments