- Down interest rates: When you are each other loan designs provides similar rate of interest pages, this new fifteen-seasons mortgage generally speaking has the benefit of a lower rates on 29-seasons mortgage. The develops change-over go out, although fifteen-seasons is normally regarding a 1 / 2 a % below the brand new 30-12 months.

- Create household equity a lot faster: Usually American property owners generally flow homes otherwise re-finance from the all of the 5 so you’re able to 7 age. Following Higher Recession it window moved out over on 10 many years. If a person stretches the loan costs over to 29-age they generate restricted guarantee in their house during the early percentage of the loan. Someone who takes care of a home by 50 percent committed isnt and also make a cost that is two times as highest. There are other costs away from possession along with property taxes, insurance rates, fix & in some instances HOA fees. Such almost every other expenses helps make doing step 1/3 of one’s typical month-to-month expenses into the a 30-12 months home loan, very paying a designated number of obligations inside fifteen years in place of 30 years may only portray a thirty% to thirty-five% huge complete payment per month.

- Better lifestyle certainty: The fresh new recuperation given that 2008 economic crisis has been bumpy, which have growing earnings inequality & an elevated sense of economic suspicion than nearly any monetary recovery given that higher recession and therefore implemented the brand new 1929 stock market freeze. An upswing from globalism, dominance technical systems, delivered application having no marginal prices & phony intelligence are likely to do substantial & constant waves from structural unemployment. Few individuals know very well what the country will be as with 20 years, therefore perhaps it generally does not sound right to finance the most significant buy of their existence across 3 decades. Those who generate collateral reduced can get greater confidence inside their lives & may not be anywhere near once the concerned with what goes on whenever they beat their job 23.five years of now.

Downsides out-of fifteen-Year Home loans

- A higher monthly payment get curb your capacity to buy large returning asset classes.

- Large money will make it more complicated in order to be eligible for since high regarding that loan, forcing one purchase a smaller sized house or that then out off really works or even in another type of less prominent location.

- In the event that rising cost of living spikes having reasonable-price fixed personal debt with a lengthier cycle allows you to gain regarding the bequeath between rising prices and interest rates.

Researching Overall Mortgage Will cost you

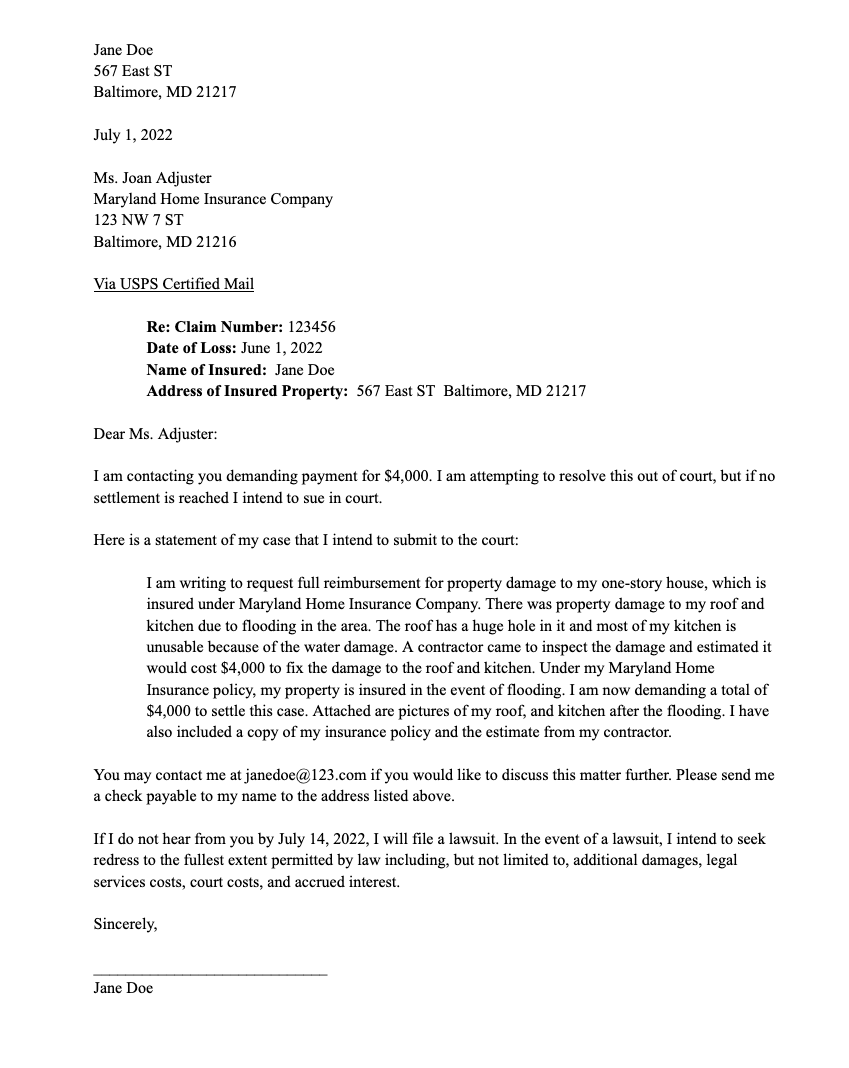

The next dining table shows mortgage balance with the an excellent $two hundred,000 home loan immediately following 5, ten , 15 & twenty years getting finance on the same home.

Please note the above utilized interest rates was basically related towards the day of book, but interest levels transform each and every day & count both to your private borrower as well as broader business standards.

The aforementioned calculations assume a good 20% downpayment to the an excellent $250,000 domestic, any closing costs paid down upfront, 1% homeowner’s insurance policies & an annual assets tax of 1.42%.

Historical fifteen-Yr & 30-Year Mortgage Rates

The second dining table directories historic average yearly home loan pricing having 15-season & 30-12 months mortgages. 2023 data is through the avoid out-of November.

20% Downpayment

Home buyers who possess a strong downpayment are usually offered straight down interest rates. Property owners which place below 20% down on a conventional mortgage also have to buy property financial insurance coverage (PMI) till the loan balance drops lower than 80% of your home’s well worth. This insurance is folded towards the price of the fresh new month-to-month household mortgage payments & assists guarantee the lender is paid in the function from a debtor default. Generally speaking throughout the thirty-five% from home buyers which fool around with funding lay about 20% down.

Conforming Mortgage Limitations

Since 2024 the fresh FHFA put brand new conforming loan restrict getting unmarried product home along the continental All of us to $766,550, that have a ceiling out of 150% you to number from inside the areas where average home prices is actually higher. The newest limit can be as comes after for a couple of, step three, and you may cuatro-product belongings $981,five hundred, $1,186,350, and $step one,474,400. New limits is actually highest into the Alaska, The state, Guam, the brand new U.S. Virgin Isles & almost every other highest-rates portion.

Recent Comments